These are the steps that you need to follow to manually check the validity of any card number against the Luhn algorithm. To understand the working of the algorithm, let’s take a random card number as an example i.e.: You could do it in a couple of minutes using a pen and paper…if you wanted to. It may sound complicated but running the Luhn algorithm on any set of numbers isn’t actually that hard.

Credit card validator app how to#

How to Manually Check the Validity of a Credit Card Number Using the Luhn Algorithm It always starts with a ‘3’ which is followed by a ‘4’ or a ‘7’ĭiscover card numbers can be identified by the following features:.The number layout in Amex cards has these two qualities: Some examples of Mastercard card numbers: Mastercard cards can be identified by these two characteristics: These are some examples of standard Visa card numbers: Visa cards have two distinct features in their card numbers: It is worth noting that other than the card number format, the rest of the details i.e., the expiry date, CVV and accountholder name are all written the same way in all layouts.Ĭoming back to the point, there are four major credit card networks in the world: Visa, Mastercard, American Express and Discover.

While the general layouts of all the credit card networks are closely similar, there are some minor distinguishing differences. What are the Number Formats of Different Credit Card Networks? This validation is done using the Luhn algorithm. This value is used to verify whether the rest of the numbers are correctly placed.

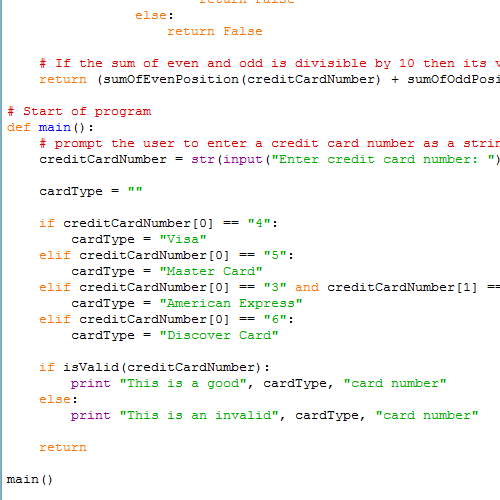

To understand the composition of a credit card number, we can break it down into four parts: What do the Digits on a Credit Card Number Mean? The calculation to compare a credit card number with your checksum is known as the Luhn algorithm. It gives merchants a way to verify the validity of a card number before accepting the customer's payment. Enter E-mail to get response? Submit How to do Credit Card ValidationĬredit card numbers are generated according to certain rules.

0 kommentar(er)

0 kommentar(er)